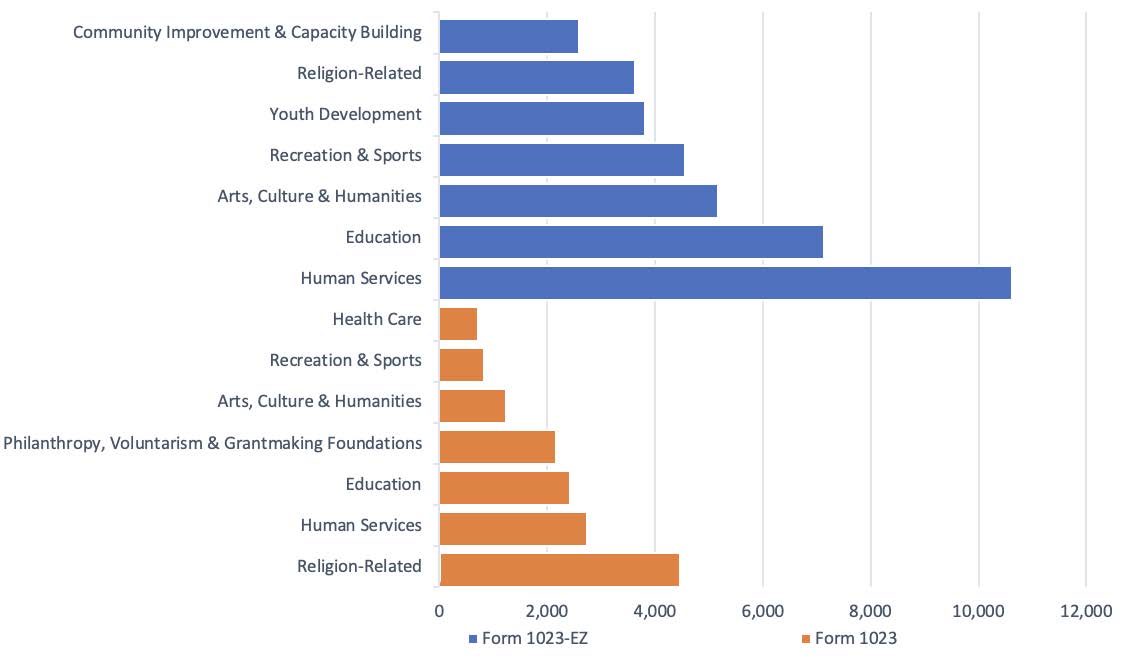

To be or stay exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be operated exclusively for one or more of the exempt purposes described in section 501(c)(3) (“exempt purposes”). The first part of a compliance analysis with respect to this requirement referred to as the...